Kapitola 1 Proč stříbro?

To první, co vás určitě napadne při návštěvě těchto stránek, je otázka „Proč vlastně kupovat stříbro?“ Časem přijdou další otázky: "Mám nakupovat stříbro jako drahý kov? Nebo jde spíše o průmyslový kov?"

Stříbro je unikátní tím, že je vlastně obojím – kovem drahým i průmyslovým. Je však třeba zdůraznit jiné důležité hledisko - myšlenku kupovat stříbro jako peníze, respektive jako monetární kov.

Co jsou vlastně současné peníze? Nejsou to pouze papírové bankovky v peněžence. V každé ekonomické příručce se píše, že peníze jsou prostředkem směny, umožňují oceňování statků a slouží jako uchovávatel hodnot. S posledním tvrzením si dovolíme zásadně nesouhlasit.

Dnešní ničím nekryté peníze funkci uchovávatele hodnot plní velmi špatně, respektive ji neplní vůbec.

U laické veřejnosti je rozšířená mylná domněnka, že hyperinflace je něco, čím se pouze straší v médiích a co se objevuje jen velmi zřídka. Opak je bohužel pravdou. Poslední fází hyperinflace je vymazání zbytků úspor občanů, formálně provedené „měnovou reformou“. Zeptejte se někoho staršího ve svém okolí, kolik zažil měnových reforem a co si koupil třeba za 100 korun před padesáti lety. Při některých vyprávění pamětníků Vám možná nebude příliš do smíchu...

Ovšem i obyčejná (a všudypřítomná) inflace ničí funkci peněz jako uchovávatele hodnot. Jistě - nepostřehnete to za rok. Za delší časové období už ano. Přitom taková „plíživá inflace“ má dopad na každého z nás. Všichni si přece spoříme na důchod - ať už formou státního sociálního pojištění nebo prostřednictvím dobrovolných penzijních fondů.

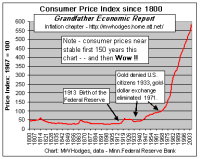

Lidé si bohužel neuvědomují, že reálná hodnota peněz, které budou mít naspořené, bude za pár desítek let zlomkem dnešní hodnoty. Neodpustíme si zmínit známý příklad z USA: $1 v roce 2008 = $0.02 v roce 1908 - neboli peníze v USA ztratily 98% své hodnoty za sto let. Drtivá část tohoto procesu přitom proběhla během posledních padesáti let, kdy USA opustily zlatý standard.

Lidé si bohužel neuvědomují, že reálná hodnota peněz, které budou mít naspořené, bude za pár desítek let zlomkem dnešní hodnoty. Neodpustíme si zmínit známý příklad z USA: $1 v roce 2008 = $0.02 v roce 1908 - neboli peníze v USA ztratily 98% své hodnoty za sto let. Drtivá část tohoto procesu přitom proběhla během posledních padesáti let, kdy USA opustily zlatý standard.

Prvotní příčinou tohoto jevu je samotná podstata peněz. V současné době všude na světě používáme tzv. „fiat money“ - tedy ničím nekryté peníze.

To znamená, že peníze nejsou kryty žádnou fyzickou komoditou nebo statkem. I americký dolar, světová rezervní měna, která by měla být stabilní, v roce 2008 procházela výkyvy v řádu desítek procent. Není se čemu divit - dnes oficiální krytí dolaru není "backed by gold" (tedy kryt zlatem), nýbrž "backed by the full faith and credit of the US government" (čili kryt plnou důvěrou v americkou vládu a její platbyschopnost). Dolar je tedy kryt pouze důvěrou ve stát, který má stále se zvyšující rozpočtové schodky. Důvěrou ve stát, jehož zadluženost veřejných rozpočtů je více než 15 bilionů dolarů ($15,000,000,000,000). Tento systém nekryté měny zatím funguje po celém světě. "Pevnost" měny se liší pouze podle toho, jak moc je který stát zadlužen.

Velmi překvapující je skutečnost, že lidé považují tento systém za normální. Lidé se domnívají, že ekonomiky takto fungují odjakživa. Opak je pravdou.

Systém nekryté měny funguje relativně velmi krátce - od roku 1971, kdy americký prezident Nixon zrušil vázanost dolaru na zlato (tzv. gold standard). Jelikož většina světových měn v té době byla fixována vůči dolaru, přišly o tuto "provázanost se zlatem" i ony. Důvod byl velice prostý. Zlatý standard totiž prakticky neumožňoval státům utrácet více, než si ve skutečnosti mohly dovolit. Proto probíhalo v historii občasné krátkodobé odtržení od zlatého standardu vždy během válek a politických převratů, kdy státy nebyly schopny financovat nadměrné válečné nebo správní výdaje.

Závěrečné shrnutí je prosté. Peníze vázané na zlato a stříbro existovaly na světě téměř 6000 let. S dnešními penězi - ničím nekrytými - experimentují státy pouhých 50 let! To je natolik krátká doba, že opravdu nemůžeme mluvit o moderním měnovém systému, ale pouze o jednom velkém ekonomickém experimentu.

Opravdu chcete být jeho součástí i Vy?

Silverum!

Zlato

Zlato Stříbro

Stříbro Euro

Euro Dollar

Dollar