IRA Acceptable

Pod označením IRA (Individual Retirement Account) rozumíme de facto typ penzijního účtu, který poskytuje specifické daňové výhody pro spoření na důchod ve Spojených státech.

Tradiční IRA je speciální typ účtu, který umožňuje investorům vkládat prostředky, které jsou daňově odečitatelné (v závislosti na výši příjmu). Peníze mohou být dále investovány do akcií, drahých kovů, dluhopisů, podílových fondů, apod., přičemž veškeré výnosy z těchto investic nepodléhají zdanění do doby, kdy majitel účtu dosáhne věku 59,5 let (v případě dřívějšího výběru prostředků z účtu vzniká majiteli pokuta ve výši 10%). V této době může majitel účtu začít čerpat prostředky z účtu, přičemž čerpané částky podléhají zdanění. Peníze musí být staženy z účtu nejpozději do 1. dubna následujícího po roce, kdy majitel účtu dosáhne 70,5 let.

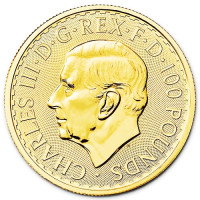

Mince IRA ACCEPTABLE

Zákon z roku 1997 týkající se daňových úlev (Taxpayer Relief Act, PL 105-34-August 5, 1997) specifikuje v článcích 304 a) a b) pravidla pro zařazení drahých kovů akceptovatelných jako investice do IRA. Toto téma dále specifikuje IRS (Internal Revenue Service, tj. dtto americký ekvivalent Finančního úřadu) v daňovém zákoně (IRS Code - IRC) v článku 408 týkajícím se IRA účtů obecně. Článek 408 (IRC)(3)(A)(i) přímo vymezuje drahé kovy akceptovatelné do IRA.

Z pohledu zlatých a stříbrných investičních mincí a slitků je kladen požadavek zejména na maximální ryzost .999 (akceptovatelné jako forma vypořádání futures kontraktů na komoditních burzách). V našem sortimentu mincí naleznete především takové, které podmínky IRA splňují. Mimo IRA mohou být ale některé mince lokálních mincoven.

Silverum!

Zlato

Zlato Stříbro

Stříbro Euro

Euro Dollar

Dollar